Section 179

Section 179 Tax Savings

Find A Commerical Vehicle

Start Saving Today

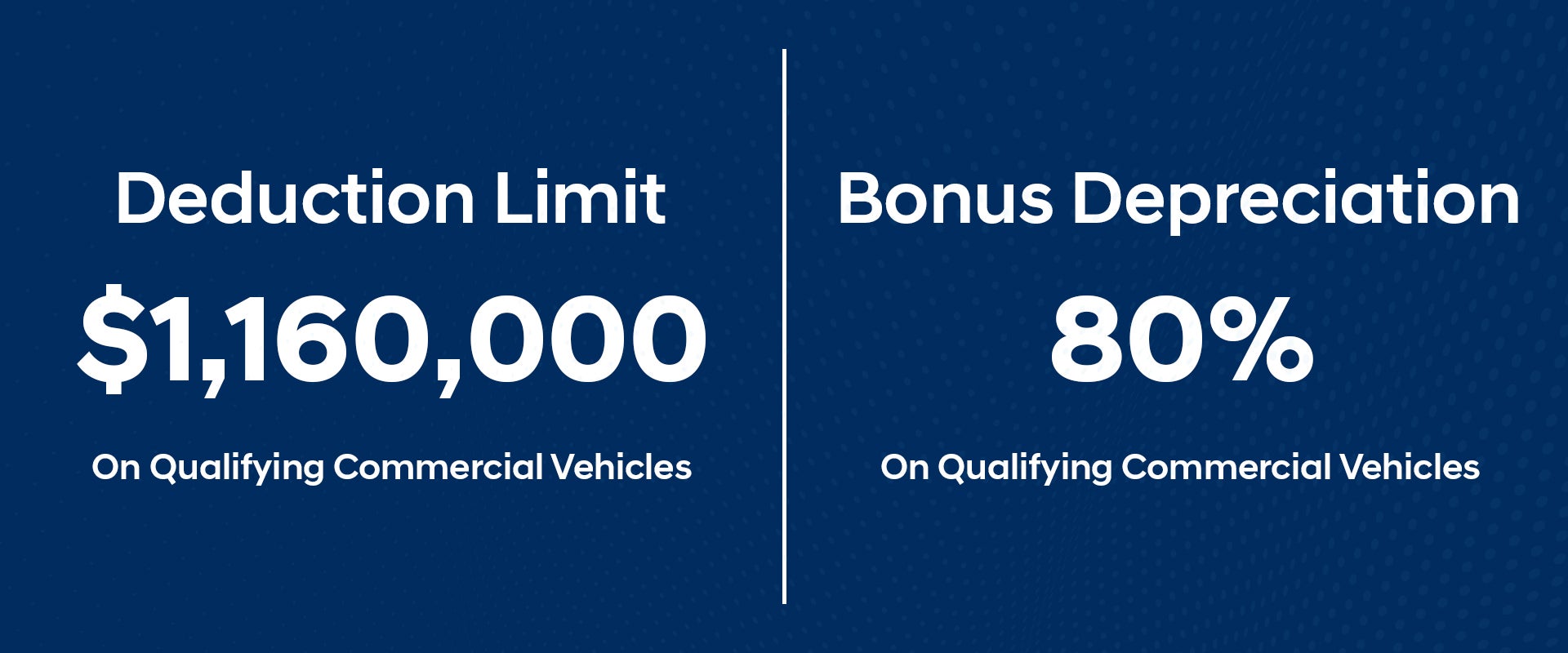

Attention all business owners! Shift gears and begin saving with the Section 179 tax deduction. The Internal Revenue Service (IRS) provides this tax break to small or medium commercial businesses to deduct from the cost of business equipment. Qualifying commercial businesses can apply a $1,160,000 deductible during a tax year from work equipment with a purchase limit of $2,890,000 under the Section 179 tax deduction.* In addition to this tax break, businesses can have an 80% bonus depreciation on new and pre-owned vehicles. Are you interested in using a Ford model for your business? Contact Prince Frederick Ford to learn more about Section 179 savings and discover which Ford vehicles qualify!

Eligible Ford Vehicles

Plenty of Ford models can be used under the Section 179 tax deduction. Any Ford vehicle can be used as long as transportation is integral to your business operations. To qualify for this tax break, your business must prove that the vehicle is being used commercially more than 50% of the time for business purposes. Whatever your field of work is, a Built Ford Tough® model is an ideal business partner. If you need a trusty truck with hefty capabilities, take a look at America’s favorite Ford F-150 or the heavy-duty Ford Super Duty® Series. Business-friendly SUVs and vans include the roomy Ford Expedition, the Ford Explorer, and the Ford Transit. If you’d like to opt for a planet-friendly, efficient vehicle, take a look at the all-electric Ford F-150 Lightning and the Ford E-Transit.

Commercial Ready Investment

Are you prepared to make the most of your business investments? Start saving now with the Section 179 tax deduction and find the Ford model that best suits your business needs. Visit Prince Frederick Ford to browse your available options and take a test drive!

We strive to provide accurate information, but please verify options and price before purchasing. All vehicles are subject to prior sale and financing is subject to approved credit. New vehicles: All discounted internet prices exclude tax, tags, and a processing charge of $799 (not required by law). Internet Pricing may include current promotions, retail bonus cash, college grad rebate, military rebate, retail trade-in assist, conquest cash, or other manufacturer rebates at the time of pricing. Ford financing may be required on select models for a portion of the manufacturer rebates. You may not qualify for all incentives. Internet Sales Prices are subject to change as well as manufacturer rebates and incentives may vary based on your zip code. Additional manufacturer rebates and incentives may apply to those who qualify. Prices are valid based on current Ford Motor Company incentive program time periods, which vary by model. Advertised prices may not be compatible with "special factory financing". MSRP Is the Manufacturers Suggested Retail Price. Actual dealer pricing may vary. See dealer for details.

Images – Vehicle images shown may include stock photography and may not depict the actual vehicle available for sale. Colors, trims, features, and equipment shown in images may vary from the actual vehicle. Some vehicles may still be in transit to the dealership. Please contact us by phone or email prior to your visit to confirm current availability.

Availability – Inventory is updated regularly but may change without notice due to prior sales. Please check with the dealership directly to confirm the availability of a specific vehicle. Financing options are based on credit approval through third-party lenders. We do not provide direct financing but will support the customer in submitting required documentation to lenders upon request.

Disclaimer – We strive to ensure that all vehicle information is accurate and up to date. We encourage customers to contact the dealership to verify pricing, equipment, and any promotional incentives prior to purchase. Prices may be adjusted at any time to correct errors or account for changes. Information provided by manufacturers or third-party sources is believed to be reliable, but accuracy is not guaranteed. By using this website, you acknowledge and accept these terms. For complete details, please reach out to the dealership.

Credit Card Payments – Please note that our credit card processing partner applies a 3% convenience fee to all credit card transactions. This fee is assessed by the merchant services provider and applies only to credit card payments. Other payment methods are not subject to this fee.

More Info

| Monday | 9:00AM - 8:00PM |

| Tuesday | 9:00AM - 8:00PM |

| Wednesday | 9:00AM - 8:00PM |

| Thursday | 9:00AM - 8:00PM |

| Friday | 9:00AM - 8:00PM |

| Saturday | 9:00AM - 8:00PM |

| Sunday | Closed |

| Monday | 7:30AM - 6:00PM |

| Tuesday | 7:30AM - 6:00PM |

| Wednesday | 7:30AM - 6:00PM |

| Thursday | 7:30AM - 6:00PM |

| Friday | 7:30AM - 6:00PM |

| Saturday | 8:00AM - 2:00PM |

| Sunday | Closed |

| Monday | 7:30AM - 6:00PM |

| Tuesday | 7:30AM - 6:00PM |

| Wednesday | 7:30AM - 6:00PM |

| Thursday | 7:30AM - 6:00PM |

| Friday | 7:30AM - 6:00PM |

| Saturday | 8:00AM - 2:00PM |

| Sunday | Closed |

*See your tax professional for complete details.